You’ve made it to Thursday!

It’s almost the weekend, but we are nowhere near the end of seeing or hearing about the US tariff wars. If we get a dollar for every time we see the US tariff wars in the news cycle, we might as well not be writing this newsletter and lounging on an island.

Here’s also what you should keep top of mind: Hertitude is a safe space for women to celebrate, connect, and dance the night away after the stress of Q1 2025. Get tickets for yourself and loved ones at 20% off when you use the code TECHSIS25.

Let’s get into today’s edition.

Telecoms untouched by Trump’s tariff—still touched by inflation, though

Kenya’s Central Bank continues its rate-cutting spree in March

Is regulated blockchain technology where payments are headed in Nigeria? Argue for or against

World Wide Web 3

Opportunities

Telecoms

Telecoms untouched by Trump’s tariff—still touched by inflation, though

Nigeria’s telecom sector is likely to dodge the 14% US export tariff. Why? Because they import almost everything. “It won’t affect the industry much because the operators import everything they use directly,” said Tony Emoekpere, basically saying, “We don’t export, so we’re chill.”

But before the industry pops champagne, telecom leaders are eyeing the ripple effects like a suspicious WhatsApp voice note. If Nigeria’s non-oil export revenue drops, it could mess with foreign exchange reserves, inflate prices, and make importing those shiny telecom gadgets more expensive.

Gbenga Adebayo of ALTON threw in a cautionary “but wait,” noting international call rates could get pricier if the US starts taxing calls like they’re luxury goods. Add inflation and budget-conscious customers, and it’s a recipe for telecom headaches—minus the free data.

Operators, not known for subtlety, recently hiked service tariffs by 50% to keep the lights on and maybe fix that “network unavailable” message we all love. But consumers aren’t buying the “better service incoming” pitch, especially when the connection still ghosts mid-call.

In short, while the tariff didn’t land a direct punch, the economic side effects are lurking like bad reception during a storm. Luckily, the Nigerian government is stepping into negotiation mode—hopefully with better signal strength than the average smartphone in rural areas.

Issue accounts in NGN, KES, EUR, USD & more with one integration. Send & receive funds seamlessly across borders; no more banking hassles or complex conversions. Create an account for free & go global today.

Economy

Kenya’s Central Bank continues its rate-cutting spree in March

In its continuous march to stimulate economic growth and encourage private sector lending, the Central Bank of Kenya (CBK) cut its benchmark interest rate to 10% yesterday. The 75 basis points cut is the country’s fifth consecutive rate cut, surpassing the expectations of economists who had anticipated no change.

The CBK’s decision comes against a backdrop of rising non-performing loans (NPLs), which have reportedly reached a record high of KES 700 billion ($5.4 billion).

By lowering the policy rate, the CBK wants to encourage banks to follow suit and cut lending rates, extending more credit to the private sector and stimulating economic activity.

The CBK has made it cheaper and more predictable for banks to borrow money from each other. It reduced the gap between its benchmark interest rate and the rates used for short-term lending, helping to keep borrowing costs steady.

The rate cut presents both an opportunity and a challenge for lenders. On one hand, lower interest rates can lead to increased borrowing, potentially increasing their loan books and profitability. On the other hand, the surge in bad loans could make banks cautious about giving out credit to prevent losses.

However, with the CBK trying to enforce compliance, it is more likely that banks will choose to assess risks more carefully than cutting credit.

In the broader economy, the CBK maintains its 2025 economic growth forecast at 5.4%, up from 4.6% in 2024. Inflation remains low and stable at 3.6% in March, within the target range of 2.5%-7.5%.

Zap is Paystack’s first consumer-facing app designed for simple, fast and secure payments via bank transfer. Download Zap on Android and iOS →

Blockchain

Is regulated blockchain technology where payments are headed in Nigeria? Argue for or against

Where do you think payments in the financial services sector are headed?

Here’s the roll call of popular options: contactless payments and Nigeria Quick Response (NQR) codes. Few people will mention blockchain-based payments. Save for stablecoins, which is currently gaining popularity, the opportunities for crypto and blockchain technology payments have been slim, especially in Africa.

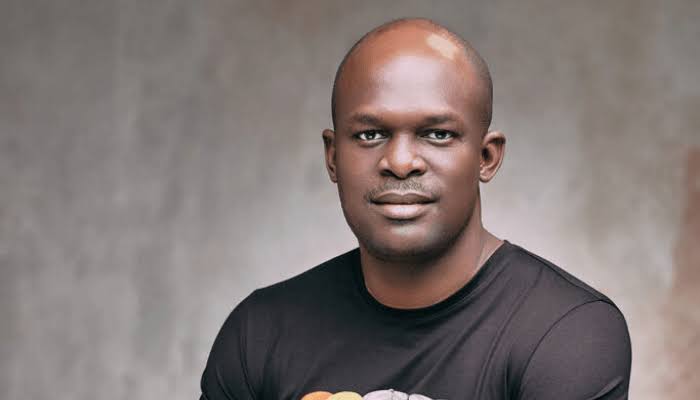

But if you ask Obi Emetarom, CEO of Zone, the future of payments—and the technology that will build it—is regulated blockchain.

A regulated blockchain enables payments to flow through a network rail, providing banks and fintechs with transparent access to payment records on a shared ledger. Without the bureaucratic process involved in exchanging information between one another, it will allow transaction settlements to become quicker.

In addition, it doesn’t take away control and oversight from regulators, making the technology a key selling point for the government.

Regulated blockchains are faster, safer, and provide better oversight against non-compliance with money movement rules that have been a bane for many regulators and even some financial service providers.

Nigeria has already dipped its toes into blockchain waters before when it created the eNaira, but according to Emetarom, we’re now at a tipping point where regulated blockchain can improve how money moves in the country.

Yet, the lack of proven success models could make it harder for regulators to say yes to the technology. While some countries have adopted regulated blockchain in parts of their payment systems, they’ve not been transparent about how it works. This lack of data provides little real-world evidence to show African regulators why it’s a good idea.

But this is the challenge Zone is taking on.

Read on to find out why Obi Emetarom thinks regulated blockchain is the next evolution of financial services.

The Moonshot Book Dealbook is lauching very soon. Packed with a handpicked selection of the most promising startups, this exclusive resource is designed to connect top investors with high-potential opportunities. If you’re interested in being among the first to access the TC Dealbook, sign up on our waitlist today!

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name

Current Value

Day

Month

Bitcoin

$82,107

+ 7.41%

+ 2.55%

Ether

$1,622

+ 11.96%

– 14.55%

XRP

$2.00

+ 11.46%

– 5.42%

Solana

$116.01

+ 10.16%

– 5.83%

* Data as of 06.30 AM WAT, April 10, 2025.

Opportunities

Lagos Innovates (LSETF) is offering workspace vouchers to startups in Lagos to ease rising operational costs. Startups can access subsidised co-working spaces with reliable internet, power, and a supportive entrepreneurial community. The program is open to Lagos-based startups looking to reduce overheads and focus on growth. Apply now.

After successes like Jamit, Pokecoin, and Tomachain, Lisk and CV Labs are back inviting African Web3 startups to apply for Batch 2 of the Lisk Blockchain Incubation Hub. The six-month program offers up to $20,000 in grants per project, mentorship, and access to additional funding of up to $100,000. Applications close on April 12, 2025, with the cohort starting on May 19, 2025. Apply here.

Village Capital is offering early-stage startups in Africa the chance to join its Greentech Africa 2025 accelerator. The programme supports climate tech ventures building solutions in energy access, sustainable agriculture, circular economy, and related sectors. Selected startups will receive mentorship, investor connections, and capacity-building support. The programme is open to founders based in Africa with market-validated solutions tackling climate challenges. Apply here.

In Zimbabwe, Avalon Health’s AI drops patient wait times from 45 to 20 minutes

Trump announces a ‘90-day pause’ on tariffs outside of China

Tracking the global fallout of Trump’s escalating trade war

Nigeria braces for revenue hit from oil price slump after Trump tariffs

Written by: Frank Eleanya and Emmanuel Nwosu

Edited by: Faith Omoniyi

Sign up for our insightful newsletters on the business and economy of tech in Africa.

The Next Wave: futuristic analysis of the business of tech in Africa.

TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.