by Osarumen Osamuyi and Derin Adebayo

Four days ago, Tyme Bank announced its $250 million Series D round which valued the company at $1.5 billion. This comes just under two months after Moniepoint’s Series C, which also took the company to unicorn status.

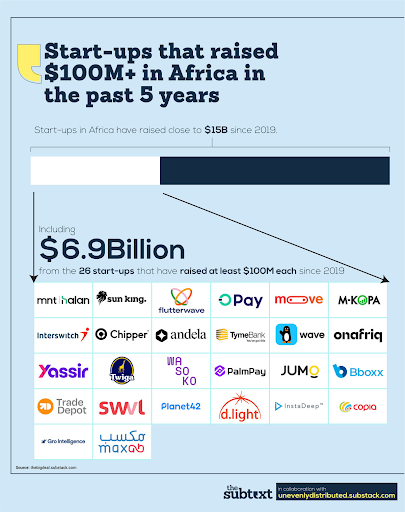

In November 2019, Interswitch became Africa’s first unicorn. This was six months after Jumia listed on the New York Stock Exchange. Since 2019, eight other African startups have hit a billion dollar valuation (add one or two more companies depending on how you feel about the provenance of companies like Go1 and Zipline). The exits have also accelerated, with companies such as Paystack, Sendwave, DPO, & Instadeep all getting acquired since 2019.

However, while the continent has seen many billion dollar valuations and has seen some companies exit, it has not seen a single company hit a billion dollar valuation and then exit. African unicorns account for a combined $14.7 billion in valuation. In comparison, since 2010, all major exits (>$100 million) for African startups sum up to just $4 billion.

We first addressed the lack of African exits in an essay titled The Chicken or The Exit? (2021). In the 11 years before that article (2010-2020), the ecosystem raised $7B in venture capital. At the time we argued that it was too early for a conversation about exits. In the three years since (2021-2023), the ecosystem raised more than $12 billion. A significant portion of that capital went to a handful of growth stage companies.

Given the level of capital that has come into the continent, and the number of growth-stage companies that have emerged, it is difficult to argue that the ecosystem is still too early to face real questions about the lack of exits. With this in mind, we’ve revisited the question in a new essay titled “When Will The Exits Cross The Road?”

The piece explores the journey of the African ecosystem since 2010. We place Africa within the context of other emerging markets while chronicling the continent’s first real venture cycle. We also explore the core tension that this cohort of African growth-stage companies must navigate if they are to achieve significant exits. Finally, the piece tries to explore how the past few years have set up the foundation for the next stage of the ecosystem’s growth.

You can read it on The Subtext, and Unevenly Distributed.

Osarumen Osamuyi is the founder of The Subtext, an Africa-focused tech analysis firm. Previously, he has studied/supported the ecosystem via roles at Meta, DFS Lab, and Ventures Platform.

Derin Adebayo is a Manager at Endeavor. Through his newsletter, Unevenly Distributed, he explores the diffusion of technology, entrepreneurship, and venture capital in emerging markets.