Five predictions for 2025

The year ahead looks set to be a pivotal one for commercial real estate. While performance is asynchronous across geographies and markets – and across asset types within markets – on balance we believe the real estate cycle has turned a corner.

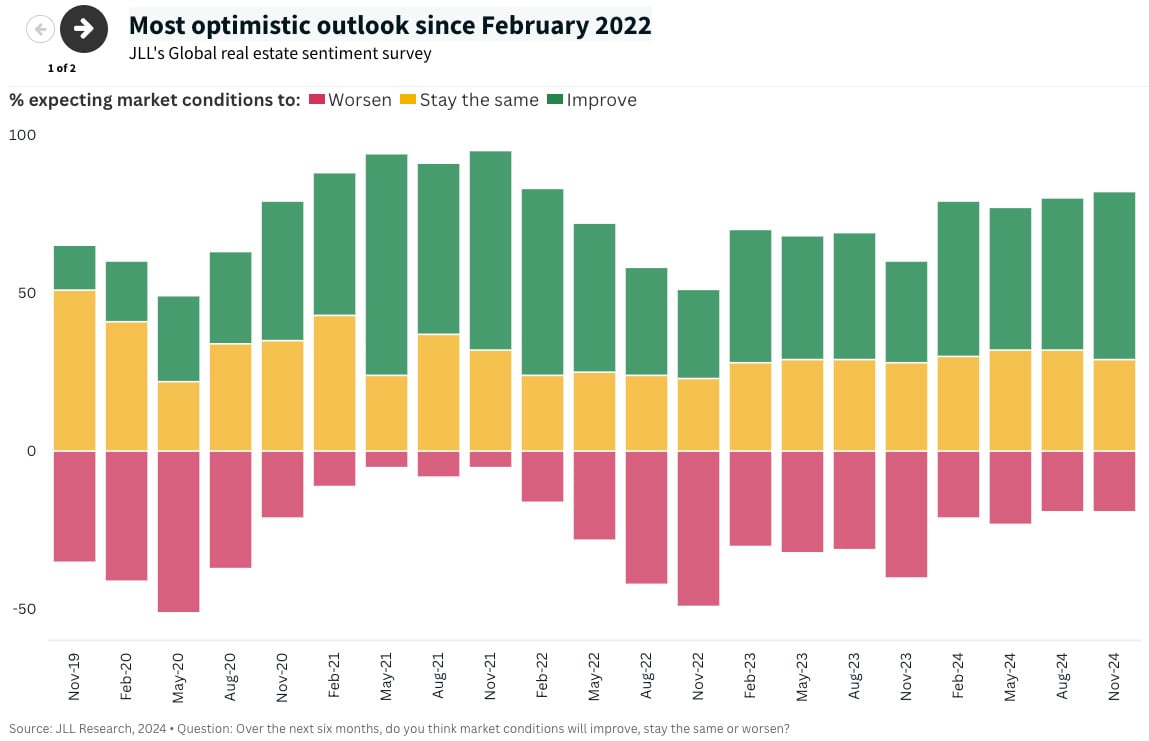

Our recent Global Real Estate Sentiment survey is indicative of this shift. As of November 2024, we saw the strongest result in nearly three years. A majority of respondents are indicating they think conditions will improve further over the next six months.

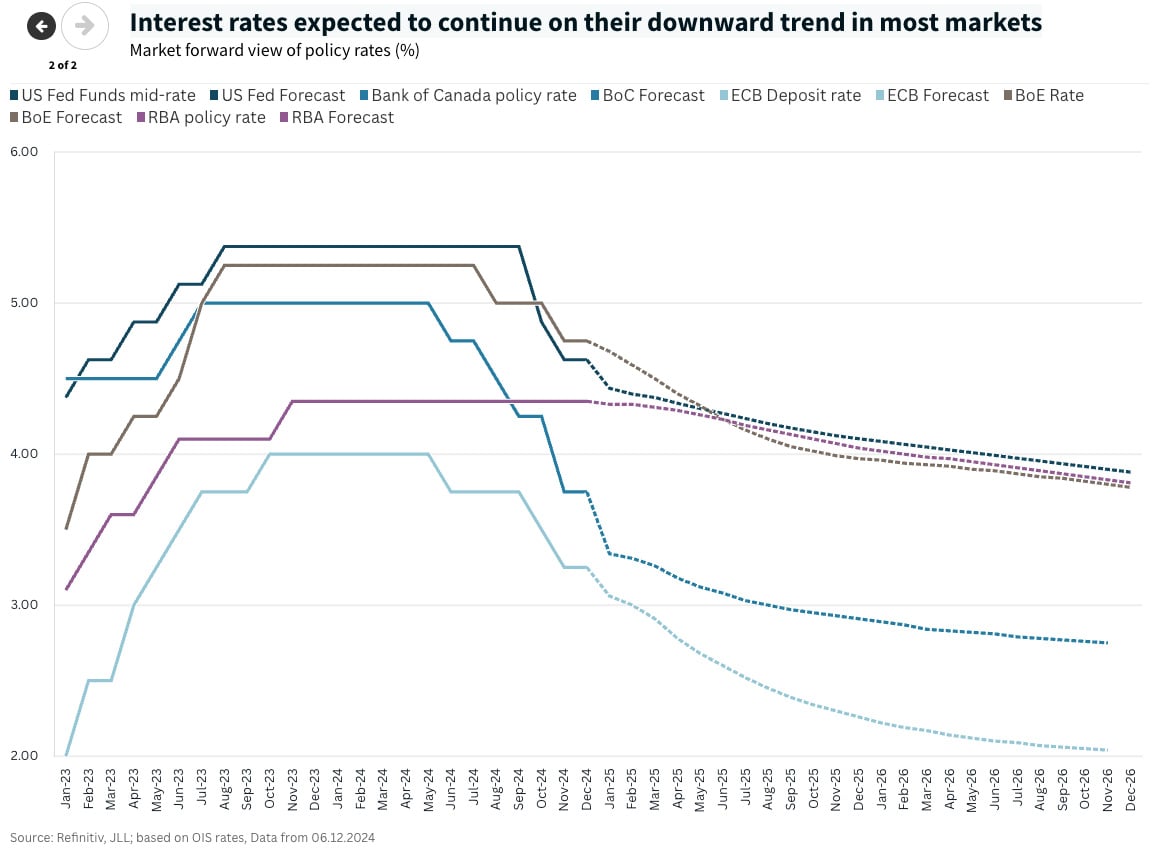

That’s not to say that 2025 will be an easy year. We are likely to see an unsettling level of uncertainty: economic, regulatory, fiscal and trade policies will continue to change and take shape, and we will be watching these closely. Interest rates in most markets will proceed on their downward trajectory, but expectations for the speed and magnitude of change have proven highly dynamic and we expect to see signals of continued volatility. Events can supersede plans at any point and alter rate-setters’ expected decisions. And this is to say nothing of the ongoing and potential geopolitical conflicts around the world.

We think opportunities will be plentiful in the coming year, but to thrive in 2025, real estate participants will need to understand the details and nuances at the market, asset and space levels in addition to the secular trends. This rising tide may not lift all boats, so it will be crucial to pick the right real estate, not just pick the index.

1. Supply shortages will worsen for in-demand assets across property types in 2025

A decline in new supply will impact almost all commercial real estate sectors in the U.S. and Europe. Broadly speaking, new building activity has dropped off amid continued high construction and financing costs and labor market constraints.

Nowhere is the decline in completions as extreme as in the U.S., where we forecast offices will see a 73% drop from peak levels (most notable in cities like Boston, Chicago and New York) and industrial assets a 56% decline. In Europe, there will be a 30% drop-off in new office completions with competition for prime space likely to be particularly strong in cities including London, Madrid and Warsaw. We expect similar or larger declines in new industrial space in Germany and the UK. The Asia Pacific region is an outlier, driven by more favorable construction and demand conditions. Only industrial space deliveries will see a slight decline from peak levels.

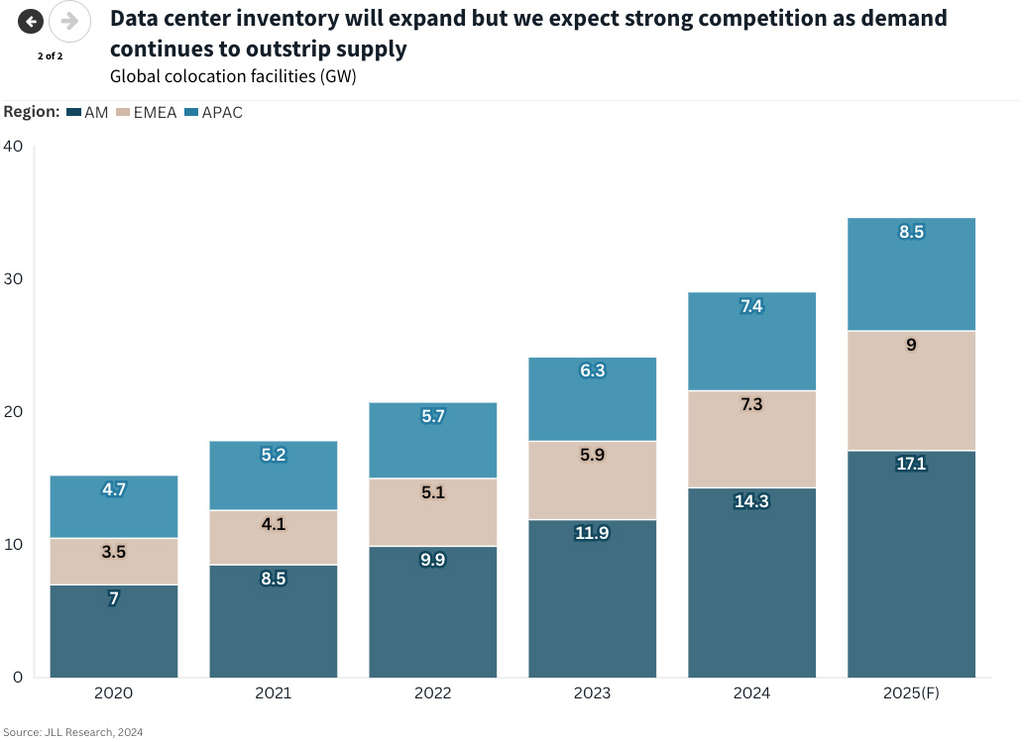

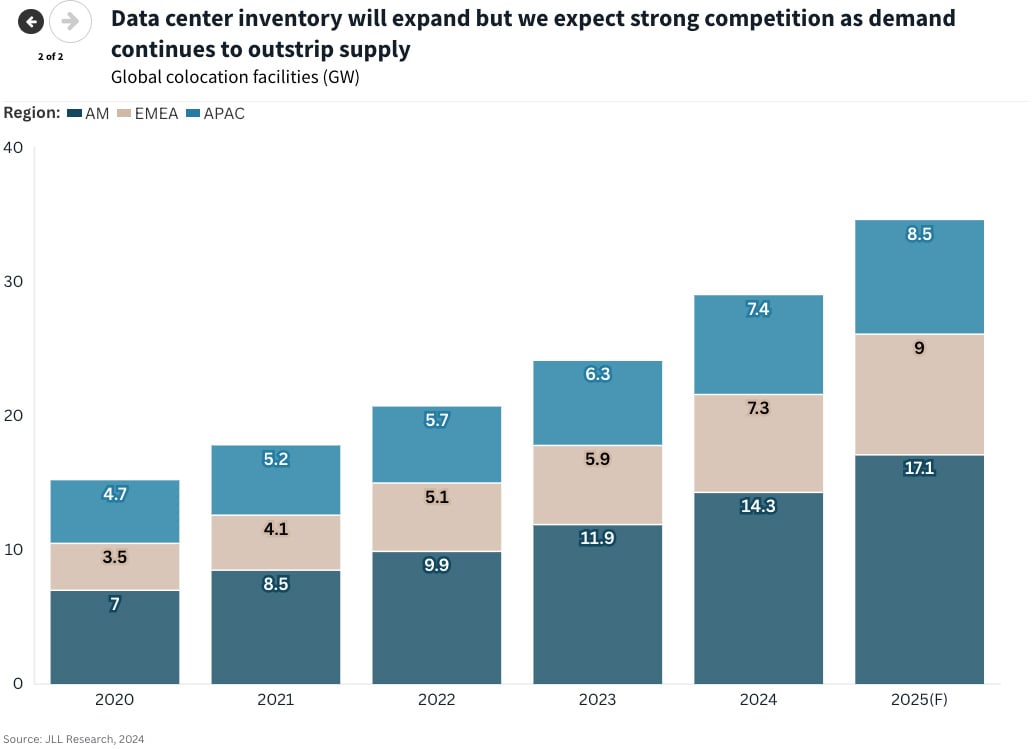

Data centers are also experiencing critical supply shortages in many markets around the world, with extremely high demand exceeding robust supply growth. Completions in 2025 are forecast to be above the 2021-24 peak across all three regions, with the largest percentage growth in markets including Atlanta, Portland and Phoenix in the U.S.; Madrid, Milan and Scandinavia in Europe; the Middle East region and Malaysia, Mumbai and Seoul in Asia Pacific. And yet shortages will still exist – such is the growing demand for data centers, boosted by AI requirements, that even this increase in supply will be only a fraction of what the market needs.

For Europe and the U.S., there are several implications from the broad-based slowing in new supply. Firstly, despite overall high vacancy in some property types, there will be a severe lack of high-quality available space options for office occupiers looking to expand or relocate into the top segment of the market. This will contribute to a higher share of renewals on lease expiry and require more proactive portfolio management. In this unique market cycle, tenants will need to plan ahead, get smart on options and costs, be creative and have a back-up plan.

Second, intensifying competition for top-quality space in the best locations will lead to a greater focus on redevelopment and retrofitting and stronger demand for emerging hot spots and next-tier assets. Supply constraints in European CBDs, as evidenced by vacancy rates of just 2.8% in Paris CBD and 1.5% for new supply in London, are leading occupiers to look in well-connected, CBD-adjacent sub-markets. And in the U.S., renovated buildings are absorbing more than 30% of occupancy gains, up by more than half compared to just two years ago.

For investors, another significant implication will be the importance of understanding supply and demand dynamics in greater detail. With interest rates and financing costs unlikely to return to 2021 lows, performance will be more determined by asset, market and sector selection and active management to drive income growth.

2. For investors, the early-mover advantage may peak in 2025

According to our research, commercial real estate investments have a long track record of outperforming on returns and adding stability and diversification to overall investment portfolios. Over the last cycle, some of the highest five-year returns were achieved with investments transacted between 2009 and 2011, in the immediate aftermath of the Global Financial Crisis (GFC). In fact, CRE assets have outperformed most other asset classes over every five-year horizon since 1998 and, even during the GFC, investors with a five-year hold period in aggregate saw positive returns.

As we leave the dislocation of the end of the last cycle behind us and look toward the upswing, investors deploying capital in 2025 are likely to see an early-mover advantage in terms of returns that will diminish as the cycle matures. Intensifying supply shortages as completions slow in 2025 will amplify competition for quality existing assets as more investors re-enter the market.

We are already seeing signs of a new liquidity cycle. More capital is showing up to the table and bidding on opportunities, and institutional investors are returning to the market with a renewed appetite for real estate. In last year’s outlook we noted the challenging balance of defense and offense as the market tried to find its footing. Now, the fear of making a mistake is being overtaken by the fear of missing out.

The implications for capital markets are becoming clearer. Over the next year, the bid-ask gap will continue to narrow as we see more transactional activity and market conditions steady; falling policy interest rates will help further stabilize the costs of debt and support renewed growth in debt origination volumes; yield compression will continue for in-favor sectors, including living, logistics and select alternative asset classes.

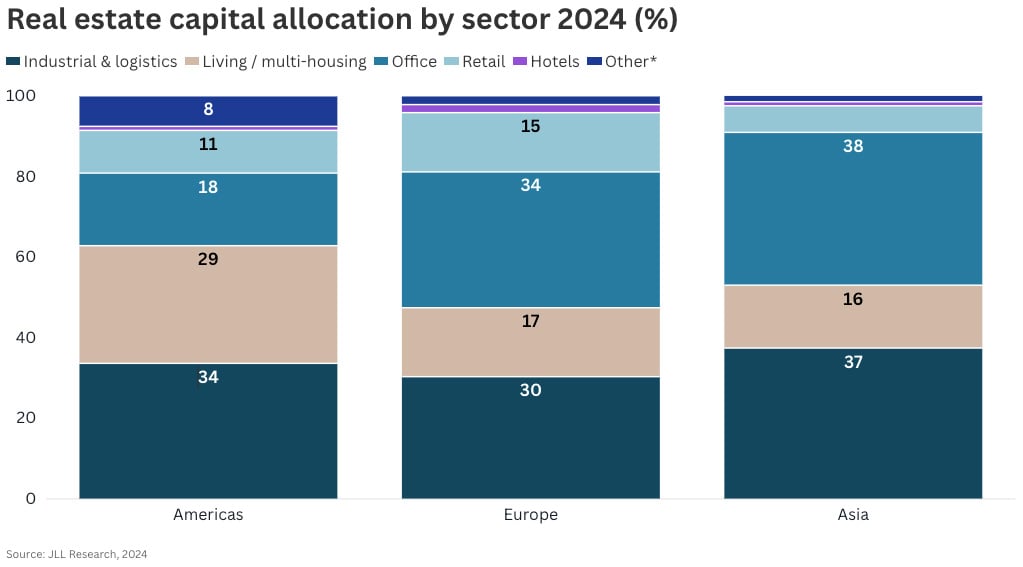

We expect demand for data centers to grow in Europe and Asia Pacific, due to the dramatic rise in data consumption, and to remain strong in the U.S. – the world’s largest data center market. Core living strategies will see US$1.4 trillion invested globally over the next five years with strong momentum in the U.S., UK, Germany and Japan, and conviction growing in some less mature markets. Nearshoring is likely to boost momentum in the logistics and industrial sectors, particularly in the U.S., and there will be compelling opportunities for investors in the office sector across all three regions, with the highest-quality office assets in the most in-demand locations leading the way as tenant demand increases.

3. Growing corporate confidence in portfolio requirements will accelerate decision-making

After several years of reducing space requirements, portfolio expansion is back on the cards.

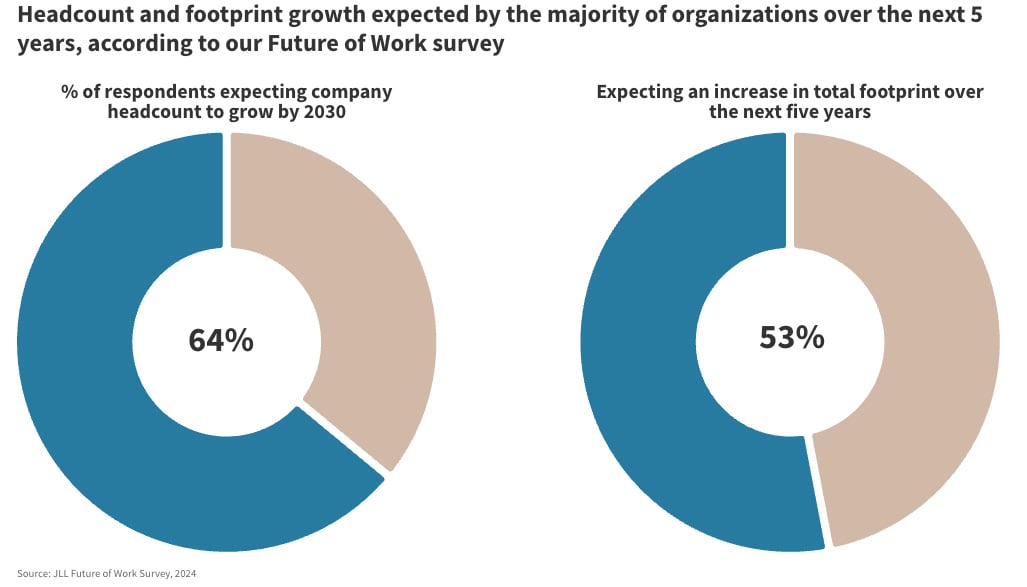

Recent announcements from high-profile global businesses indicate a trend toward mandating increased office presence, with some requiring up to five days a week and implementing attendance tracking measures. We predict office attendance policies will continue shifting toward an average of four days per week. Getting there means more space will be required: 57% of our survey respondents, both the ‘office-only advocates’ and the ‘hybrid promoters’, cited expansionary activity as a top expectation from 2025 through 2030.

However, in the short term, the focus will be on portfolio rightsizing and transforming spaces into fit-for-purpose workplaces. For now at least, many organizations have some degree of certainty around the hybrid/in-workplace split and are in a position to make real estate decisions. As a result, we expect more CRE leaders to start executing on their strategies after a period of hiatus. This can mean moving to new space or reconfiguring and redesigning existing space to better meet workforce requirements and business expectations. For organizations seeking new space, decisions made in 2025 will need to have a degree of built-in flexibility to allow for future expansion in years to come.

With less new space coming to the market and availability concentrated in less desirable buildings and locations, competition for the best space will continue to intensify. Companies need to affirm their strategy around the kind of space they are looking for and be proactive to secure it. This means more spending on office design, employee experiences and hospitality services. CBD locations, vibrant mixed-use neighborhoods, buildings with leading sustainability and green credentials and ‘destination workplaces’ that can help attract and retain talent will be in highest demand.

4. Multiple converging factors will encourage action to mitigate risk of obsolescence

There is much greater focus now on the scale of potentially obsolete assets across the real estate spectrum, as a result of shifting preferences for how space is used, changing patterns of urban development and tightening sustainability requirements. Building age and design, location and ESG considerations are the key factors real estate owners should take into account when making strategic decisions about their assets.

By our estimation, between 322 to 425 million square meters of existing office space in 66 key markets globally is likely to require substantial capital expenditure over the next 5 years – potentially US$933 billion to US$1.2 trillion – to remain viable. Stranding risk is far from evenly distributed: 44% of projected obsolescence is likely to arise in the U.S. given higher levels of structural vacancy, with a further 34% in Europe as flight to quality in select segments of the office market leads to a smaller but still significant amount of vacant product with little demand chasing it.

The full potential to create value can only be achieved through collaborative engagement between stakeholders and planning that accounts for how multiple forms and levels of obsolescence interact. This will be particularly acute in cities where new sustainability legislation is implemented beginning in 2025 and as 2030-2035 city and national net-zero targets approach.

Continued flight to quality and reshuffling of office users into top-quality space will begin to open up ample repositioning and retrofitting opportunities for real estate owners in 2025 and 2026. At the same time, housing and accommodation shortfalls will further push city authorities to accelerate construction and revise land use policies, which will enable more conversion of aging office assets to residential and hotel use. We expect this process will accelerate in 2025 but still take time to play out over the next several years due to the complexity of navigating the physical, capital and regulatory challenges.

5. Tackling cost pressures and energy security will drive an acceleration in decarbonization efforts

Decarbonization efforts are increasingly being integrated into broader real estate strategies as a form of achieving operational excellence. This is because the capex invested in optimizing energy use and reducing emissions in buildings results in lower operational costs, secure energy, regulatory resilience and improved employee attraction. This evolution will transform the concept of decarbonization from solely an ESG consideration to a critical component of operational – and risk – management, as well as a strategic economic opportunity.

Electricity demand is projected to rise in 2025 at its fastest pace for two decades (according to the IEA), in part due to AI technologies, EVs and the electrification of buildings, raising concerns about electricity costs and security of supply. Energy use is the single largest operating expense in office buildings, representing approximately one-third of typical operating costs. Light to medium retrofits can unlock between 10% and 40% in energy savings. For office properties, light retrofits save about US$4-$5 per sqm in energy costs, while a retrofit on the mechanical, electrical and plumbing (or MEP) equipment of the same building can deliver roughly US$17 per sqm – with even further savings possible with the help of AI-powered tech to continuously optimize performance.

Savings vary across asset types given differing energy intensity of operations and uses across property sectors, as well as across markets due to differences in energy prices. Because sectors like healthcare, labs and data centers are typically 2 to 5 times more energy intensive than offices, even greater cost savings can be achieved. For example, savings on MEP equipment can be in the region of US$118 per sqm for data centers and around US$50 per sqm for labs and healthcare.

Organizations’ 2025 priority should be comprehensive energy audits and feasibility studies to identify the retrofit opportunities with the highest potential returns, then to put these into practice. These will serve both the CFO’s objective of cutting operating costs and the Board’s objective of achieving its climate goals on the road to net zero.

Recovery, risk and resilience will be key themes for 2025

We believe the coming year will be characterized by strengthening demand, improved liquidity and more decisive corporate action. The next stage of the recovery cycle is underway. While the overall outlook is positive, significant risks persist, including financial and policy uncertainties, supply chain disruptions, obsolescence and concerns over energy costs and security. With these potential challenges in mind, agility and resilience will continue to be critical for success. As more market participants, both investors and occupiers, shift their balance from defense to offense to take advantage of the market opportunities, those able to respond at speed to the unexpected will fare best.

Performance will vary across geographies and property types, and in some cases differ at the sub-market and sub-sector level. However, improving conditions for the best spaces and locations across many major markets will provide considerable opportunities for investors and developers (see below for some specific areas of expected improvement in fundamentals in 2025). These same conditions may require more proactive planning by corporate occupiers, but we expect the flight to quality and portfolio optimization trends to continue. Those who understand the highly nuanced market dynamics and leverage first-mover advantage will be able to reap the rewards and create value in the next real estate cycle.

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 111,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

View source