Hotel investments represent a dynamic asset class within commercial real estate, attracting a broad range of investor types from private equity firms to real estate investment trusts (REITs) and high-net-worth individuals (HNWIs). Each investor category has a unique approach to asset acquisition, management, and divestment, making the timing and investor fit critical for maximizing a hotel’s selling price during its life cycle.

In this competitive arena, investors are often categorized into four categories based on their risk tolerance, investment strategy, and expected returns:

Core

Core Plus

Value-Add

Opportunistic

Who are these investors?

Core: are those low risk – low return investors who seek stable, income-generating properties with minimal risk. They typically expect lower returns compared to other categories as they prefer to focus on assets able to provide consistent cash flows through time with little (or even no) need for operational or structural changes. These investors prefer a long-term hold therefore they tend to prioritize stability and preservation of capital. These investors are usually after prime locations and high-quality assets operating in top-tier locations. Typical Investors in this category are: Institutional Investors (e.g., pension funds, insurance companies), REITs, Family Offices (in search of stable income streams).

Core Plus: these investors have a low / moderate appetite for risk but happy with moderate returns, similar to Core investors but more open to assets with slight operational or structural upside potential. They typically seek a balance between stable income and some (although limited) growth opportunity through minor value-add investments such as minor upgrades or operational improvements. These investors are comfortable in holding properties over the medium to long term, but they may exit earlier if growth objectives are achieved sooner. Typical investors in this category are: Institutional Investors (seeking slightly higher returns than pure core investments), Private Equity Firms (with lower risk tolerance, focused on cash flow with moderate upside) and REITs (interested in properties needing minimal enhancements).

Value-Add Investors have a moderate-to-high appetite for risk, but interest in higher returns. Value-add investors target properties with potential for increased value through operational improvements, rebranding, or renovations. They are willing to take on additional risk in exchange for higher potential returns. These investments often require active involvement in property management due to physical renovations but also in sounded asset management initiatives covering human resources restructuring or improved marketing strategies. Value-Add investors aim to create value over a shorter time horizon (typically 1-4 years) before selling at a profit, often to Core or Core Plus buyers. Typical value-add investors are Private Equity Firms (focused on significant revenue and operational improvements), Family Offices (with a hands-on approach to enhancing asset value), Real Estate Funds (seeking growth potential through asset improvement).

Opportunistic Investors feature a high risk, highest return profile. They are willing to take on the highest level of risk, often dealing with distressed assets, new developments, or properties in need of substantial repositioning. These investors buy properties at fire sale or distressed conditions and are not interested in their current trading performance but in their trading potential. Opportunistic Investors usually underwrite a transformational strategy which typically require major investments and hands-on changes, including full renovations, rebranding, or even conversions to alternative uses. This approach is also called “buy-and-flip” and, as time is of essence, these investors tend to have a shorter time horizon (often 1-3 years) and aim to exit after executing their high-impact value-creation strategies to immediately move on to the next project. Typical investors are Private Equity Firms (specializing in distressed and turnaround projects), Real Estate Funds with Opportunistic Mandates and High-Net-Worth Individuals (seeking high-reward, often through speculative projects).

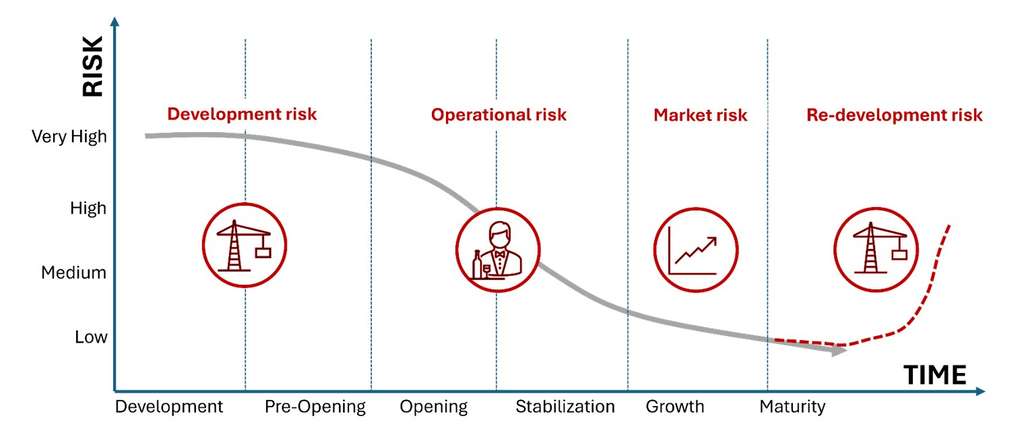

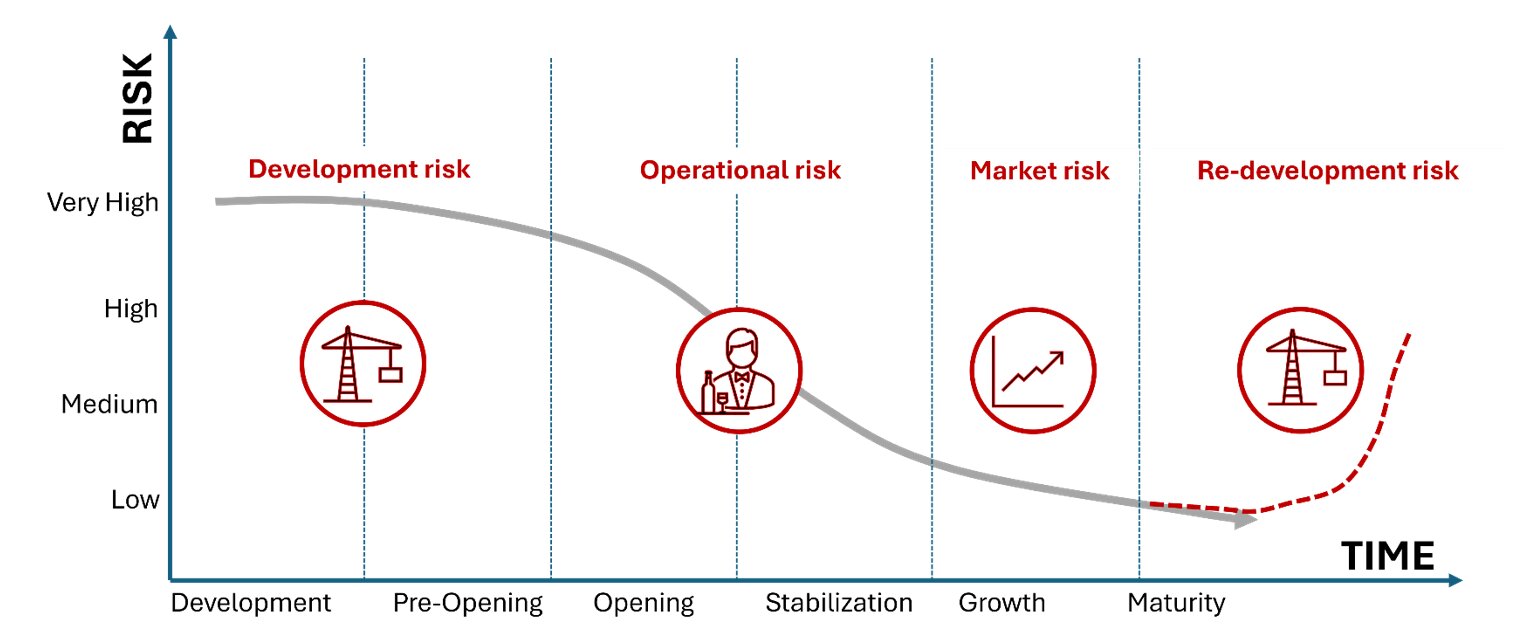

As every investor is featuring different combinations of risk versus return, not everybody is the perfect buyer during the life cycle of a hotel asset.

A greenfield (raw land) or brownfield (existing disused building) development has a high level of risk and therefore attracts only Opportunistic Investors. This includes distressed hotels, properties needing major capital infusion, or assets in challenging markets where new strategies can drive high returns as well as redevelopment projects, new builds, or complete rebranding initiatives in high-growth areas or underserved markets. Core Investors would be considering assets from the opening stage onwards (if not after completion of 1 or 2 full operational trading years). This means the hotel should have reached stabilized levels of occupancy rates and therefore be able to produce steady revenue streams. A classic example of a target for a Core investor would be a property in a prime urban centre or established tourist destinations with minimal need for renovation or repositioning.

Through the course of time, hotel assets might become “tired” and in need of refurbishment or the local market might have changed with new openings bringing the level up “a notch” (or two). For assets to continue penetrating the market, a (light) investment might be necessary. This might be the moment for Core Plus Investors seeking stabilized hotels with steady cash flow but possibly requiring light changes in their physical aspects (renovations) or business model (e.g. rebranding, or operational improvements). This might also relate to properties located in growing markets or secondary urban locations with upside potential both in cities and in resort destinations.

In case the investment might be greater, or the refurbishment risk higher due to a planned repositioning or rebranding, Value-Add Investors might step-in scouting for opportunities in emerging or secondary markets, or underperforming assets in prime locations but featuring a growth potential.

Lastly, for neglected (or distressed) properties needing major capital infusion or for those assets in challenging markets where new strategies need to be identified to drive high returns, Opportunistic Investors might put down enough “dry powder” to finance redevelopment projects, add new builds, or complete rebranding initiatives in high-growth areas or underserved markets.

Conclusion

Navigating the hotel investment landscape involves aligning your property’s life cycle phase with the investor category best suited to its current and future potential. It seems that each stage of the life cycle has a clear investor profile in mind capable of moving the asset forward: opportunistic and value-add investors have a vision/strategy and risk appetite to develop a new property form raw land (greenfield) or bring a distressed building into new life (brownfield) with vision, dedication and project management skills fueled by financial investment. Upon opening of the hotel, when development risk is gone, new investors (such as value-add or core plus) might be the perfect buyers to purchase an asset on its final steps of ramping up. Ultimately, once the asset has recorded a few years of stabilized financial performance, Core investors might be the perfect purchasers. As yield expectations might vary in % figures across the globe, risk/return expectations also vary greatly amongst Private Equity firms, REITs and Institutional Investors.

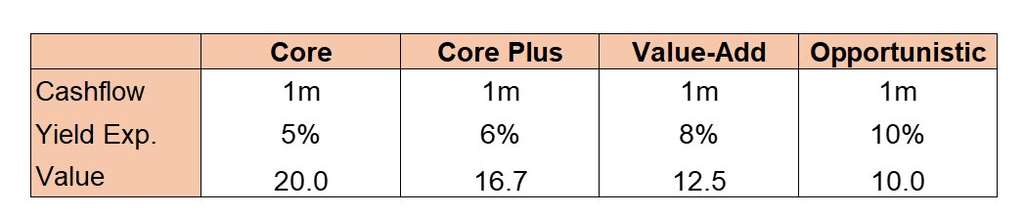

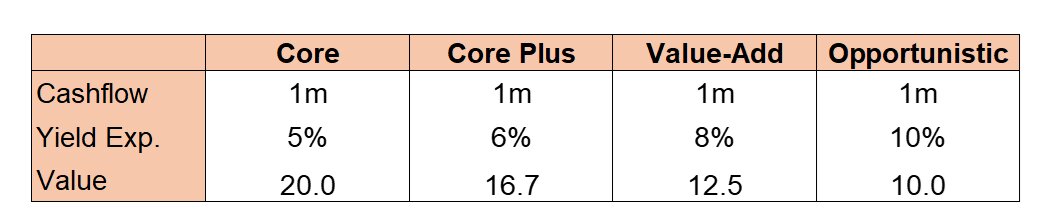

In the table below we are trying to give a generic impact of how yield expectations (based on decreased risk) can ultimately increase price.

Identifying the right investor at each stage of the life cycle will help you maximize your asset’s value at sale. And why would you sell your asset(s) for less?

Giuliano GaspariniBoard member of HAMA Middle East HAMA