Asia-Pacific hotel market: Impact of China’s reopening on pricing and demand

The hospitality landscape in 2024 is a study in contrasts. As we look toward 2025, global pricing trends reveal a resilient industry, but one marked by stark regional differences. Drawing on Lighthouse data, we’ll cut through the noise to examine the current state of play, with a spotlight on Asia-Pacific.

Our global analysis paints a picture of uneven recovery. Some regions are charging ahead, while others grapple with lingering challenges. This patchwork of progress hints at the complex forces reshaping our industry post-pandemic.

Let’s dive into the data and unpack the insights that matter.

Latin America leads the charge

Latin America has emerged as the star performer in hotel pricing recovery. With a remarkable 12.2% year-over-year increase in pricing from 2023 to 2024, the region has not only bounced back but significantly outpaced its pre-pandemic levels.

Key driver: A growing middle class with increased travel propensity, fueled by stabilizing inflation and strong labor markets.

Takeaway: This robust demand presents opportunities for more aggressive pricing strategies and yield management techniques in the Latin American market.

Europe and North America: Stability amid uncertainty

Europe has shown steady growth, with pricing increasing from $166 in 2023 to $170 in 2024. This 2.4% uptick, while modest, signals a stable recovery trajectory.

North America, meanwhile, appears to have reached a post-recovery equilibrium, with pricing holding steady at $155 in both 2023 and 2024.

Takeaway: In these mature markets, refining segmentation strategies and optimizing channel mix could drive incremental revenue gains.

Spotlight on Asia-Pacific: A region of contrasts and interconnected markets

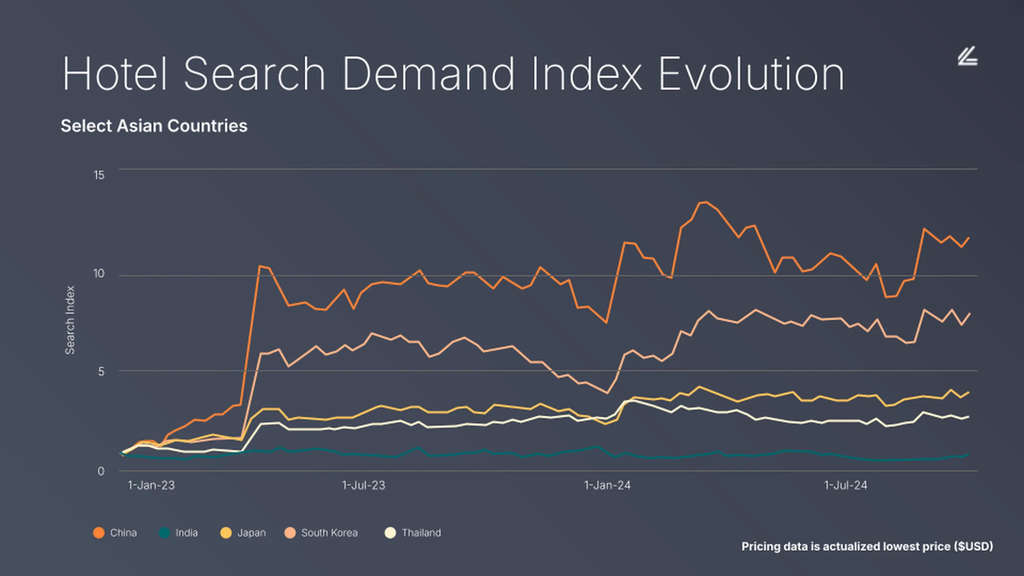

APAC presents a complex and fascinating picture of hotel demand recovery, with select countries following their own trajectory while also being influenced by regional dynamics. Our Hotel Search Demand Index Evolution data for select Asian countries reveals intriguing patterns and interdependencies.

China: The catalyst for regional recovery

China’s reopening to foreign tourists and international travelers in March 2023 marks a pivotal moment in the region’s hospitality recovery. The data shows a dramatic spike in search demand for China in April 2023, illustrating the pent-up demand for travel to and from the country.

Key insight: China’s reopening had a ripple effect across the region, demonstrating its role as a major driver of travel demand in Asia.

South Korea: Riding China’s wave

Despite reopening in Spring 2022, South Korea experienced a significant surge in search demand coinciding with China’s reopening. The data shows China and South Korea’s search demand moving in tandem thereafter, highlighting the interconnectedness of these markets.

Key insight: China’s influence extends beyond its borders, stimulating travel across the region.

Japan and Thailand: Gradual recovery with a China boost

Both countries show a continued ramp-up through 2023, with a noticeable uptick coinciding with China’s reopening. The data suggests a leveling off in 2024, indicating a possible stabilization of demand.

Key insight: While following their own recovery trajectories, these markets also benefited from China’s return to international travel.

India: Steady and independent

Having reopened in Fall 2021, India shows stable and consistent search demand since the beginning of 2023. Unlike its regional counterparts, India’s demand appears less influenced by China’s reopening.

Key insight: India’s travel market demonstrates resilience and independence, potentially driven more by domestic factors than regional trends.

Our data underscores the interconnected nature of Asian travel markets. Changes in one major market, particularly China, can have significant effects across the region.

Diverse recovery patterns: Each country’s unique reopening timeline and demand evolution highlight the need for tailored strategies in different markets.

China and India: A tale of two powerhouses

The Asia-Pacific region presents a complex picture, best exemplified by the contrasting situations in China and India.

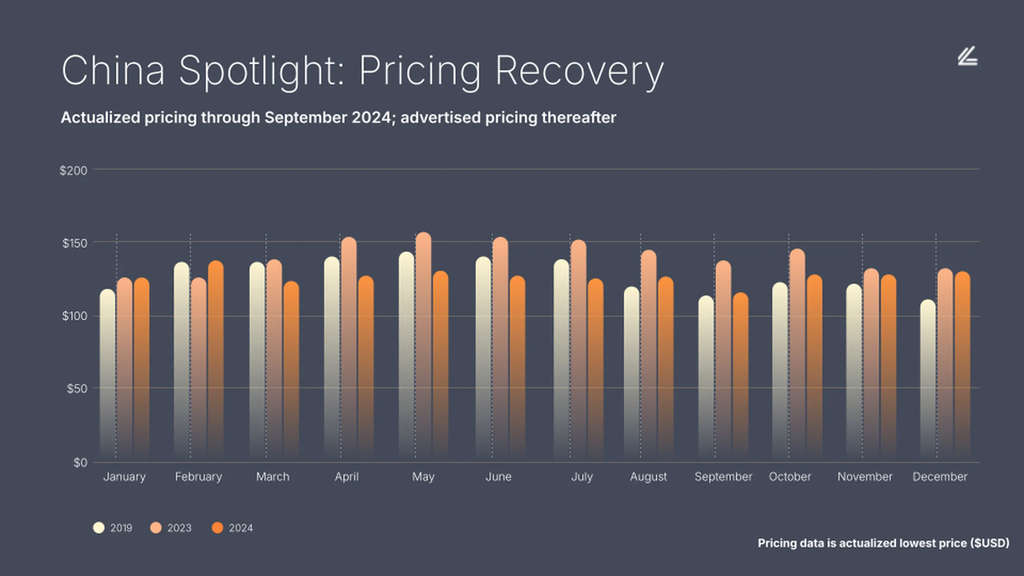

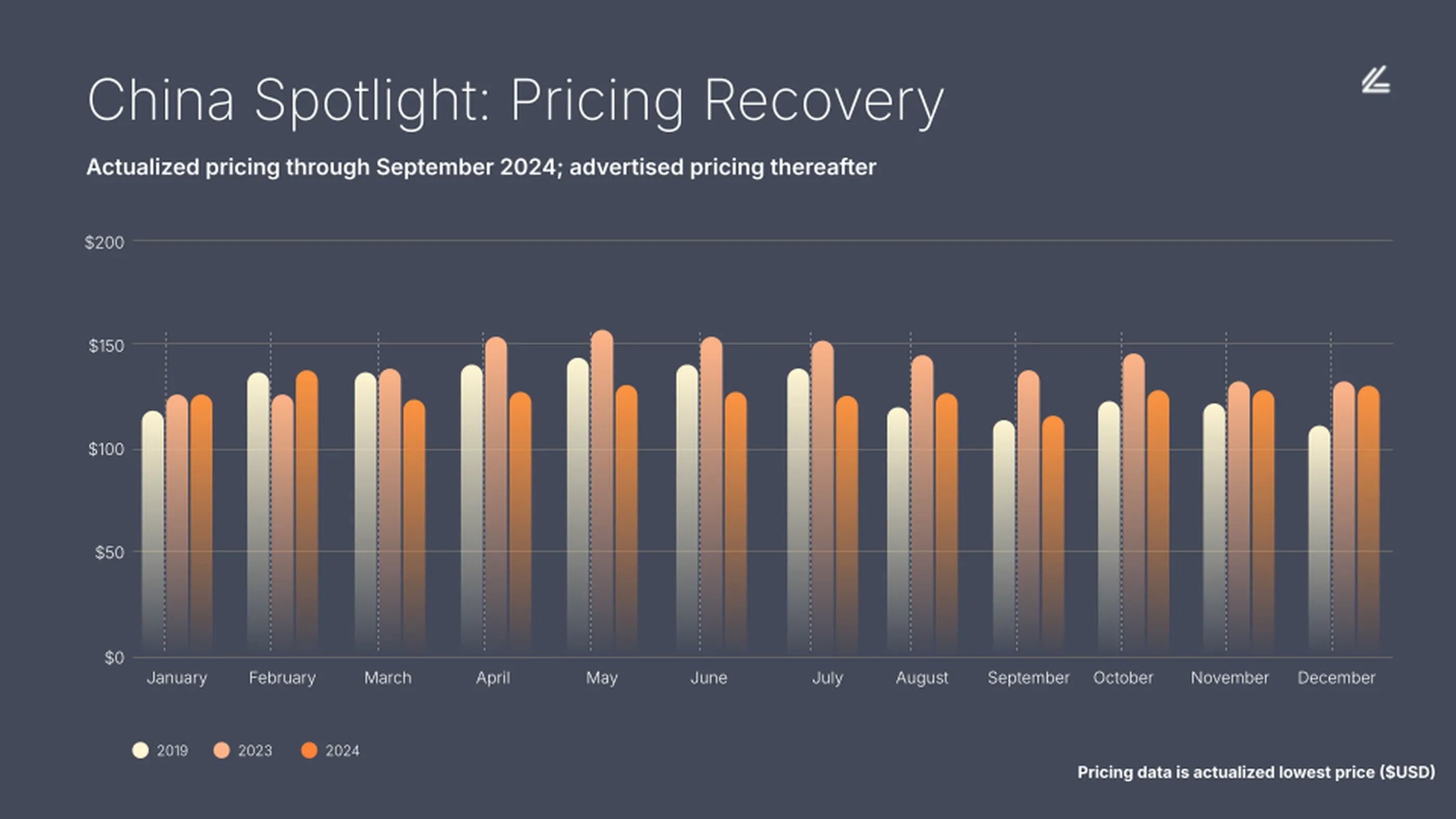

China: Navigating demand softening

After a promising recovery in 2023, China’s hotel industry is facing new challenges. From March 2024 onward, pricing levels have consistently fallen below their 2023 counterparts, indicating a softening in demand.

Key factors:

Decreased consumer confidence

Relatively high interest rates

Tighter disposable income

Strategies for the Chinese market:

Implement more dynamic pricing models to capture price-sensitive travelers

Focus on domestic tourism packages to offset potential declines in international arrivals

Leverage advanced forecasting tools to anticipate demand fluctuations and adjust inventory accordingly

India: A year of two halves

India’s hotel industry started 2024 strong, with pricing consistently exceeding 2023 levels for the first seven months. However, September saw a significant 22% year-over-year price drop, potentially linked to the country’s ongoing aviation crisis.

Strategies for the Indian market:

Monitor airlift capacity closely and adjust pricing strategies in tandem with aviation trends

Explore partnerships with domestic airlines for package deals to stimulate demand

Implement flexible cancellation policies to encourage bookings despite air travel uncertainties

The APAC dichotomy: Implications for global hospitality

The contrasting situations in China and India underscore the need for localized strategies, even within the same broader region. This serves as a reminder that global trends, while informative, must always be contextualized for specific markets.

Actionable strategies for 2025

Embrace local, real-time pricing: Move beyond blanket regional strategies. Utilize granular, real-time data to develop pricing strategies tailored to specific cities or even neighborhoods within major markets.

Leverage forward-looking data: In volatile markets, historical data alone is insufficient. Invest in technology that provides predictive analytics and real-time demand indicators to stay ahead of market shifts.

Optimize distribution mix: With shifting traveler behaviors, regularly reassess distribution strategies. Be prepared to quickly pivot towards channels showing the highest demand and profitability.

Focus on total revenue management: Look beyond room revenue. Develop strategies to maximize ancillary revenue streams, particularly in markets facing pricing pressures.

Invest in upskilling: The complexity of today’s market demands continuous learning. Stay updated on the latest technologies and methodologies to maintain a competitive edge.

Charting the course ahead

Looking ahead to 2025, the world of hospitality continues to present both challenges and opportunities. The key to success lies in remaining agile, data-driven, and market-specific in our approaches.

While global trends provide valuable context, it’s the ability to translate these insights into localized, actionable strategies that will set apart high-performing properties. By staying informed, leveraging advanced analytics, and continuously refining strategies, you and your team can not only weather the current uncertainties but position your property for long-term success.

Remember, in today’s dynamic market, success is not just about pricing – it’s about creating value, driving profitability, and ultimately, delivering exceptional guest experiences that nurture long-term loyalty and revenue growth for your commercial team.

Capture more revenue with Lighthouse’s industry leading data sets. Get in touch!

About Lighthouse

Lighthouse (formerly OTA Insight) is the leading commercial platform for the travel & hospitality industry. We transform complexity into confidence by providing actionable market insights, business intelligence, and pricing tools that maximize revenue growth. We continually innovate to deliver the best platform for hospitality professionals to price more effectively, measure performance more efficiently, and understand the market in new ways. Trusted by over 70,000 hotels in 185 countries, Lighthouse is the only solution that provides real-time hotel and short-term rental data in a single platform. We strive to deliver the best possible experience with unmatched customer service. We consider our clients as true partners—their success is our success. For more information about Lighthouse, please visit: https://www.mylighthouse.com.

View source