Highlights

Strong start, weak finish net flat RevPAR in the U.S.

Lower TSA volume with the start of Lent and a later spring break

Inconclusive evidence on U.S. border travel flows impact

Weekly global occupancy down

Strong start, weak finish

It was a mostly flat first full week of March for U.S. hotels with revenue per available room (RevPAR) up a modest 0.6%, the result of a 2.1% increase in average daily rate (ADR) being offset by an occupancy decline of 0.9 percentage points (ppts).The week started strong with RevPAR growth above 3% year over year on Sunday through Tuesday. Then began the decline, which worsened each day into Saturday (-4%). Strong ADR gains lifted the start of the week and falling occupancy deflated the end.

One possible headwind to YoY growth is the calendar. Lent began on the same Wednesday in 2019, and we saw a similar softness in occupancy. Since 2000, Lent has occurred in week 10 three other times, with end-of-week softness seen two other times. We also believe that a later spring break contributed to the lackluster performance. According to STR’s School Break Report, about 10% fewer college and K-12 students were on Spring Break this past weekend versus last year. Furthermore, a review of TSA airport screening revealed a second consecutive weekly decrease, falling 1.8% after a 0.7% decline in the prior week.

The Top 25 Markets saw the largest swings in performance.

New Orleans, lifted by Mardi Gras, delivered double-digit RevPAR gains Sunday through Tuesday and a double-digit decline on Saturday.

Nashville, Los Angeles, and Denver followed with positive double-digit starts and negative double-digit ends. In total, 17 of the Top 25 Markets posted Sunday gains, while 19 saw Saturday declines.

Two stand out markets were Chicago and Anaheim (Orange County). Both saw double-digit RevPAR growth during the week via conventions. Orange County hosted the annual Natural Products West conference one week earlier this year and saw RevPAR advance by more than 70% Tuesday through Thursday.Across the rest of the country, RevPAR was flat on Sunday and hovered around +1% Monday through Wednesday. Thursday and Friday were up by about 2%. Saturday followed the Top 25 Market pattern with most markets seeing negative RevPAR changes.

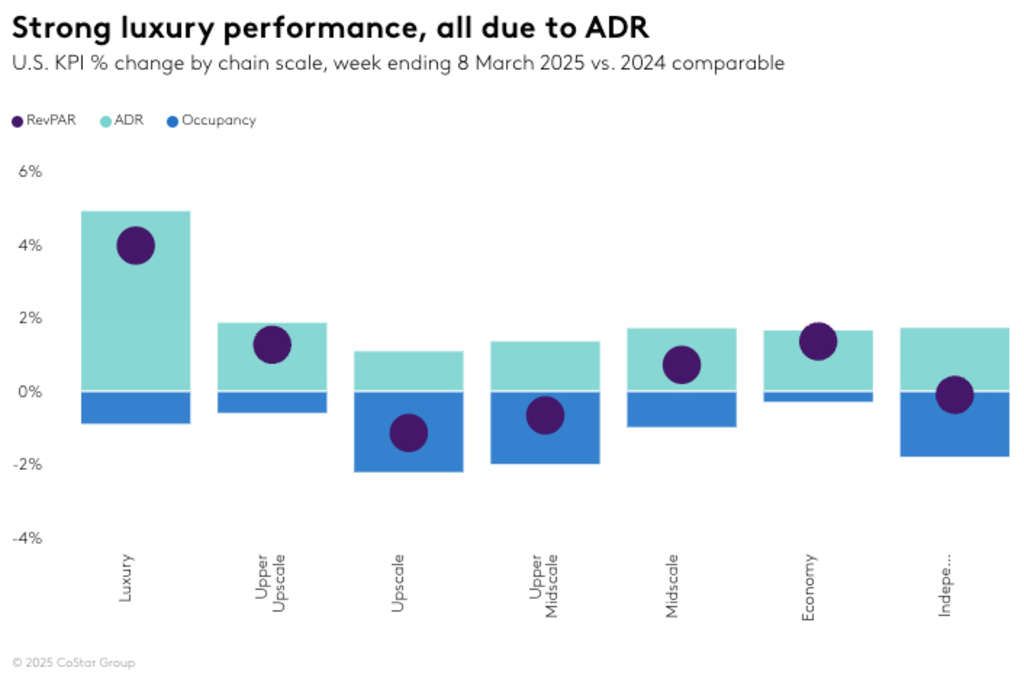

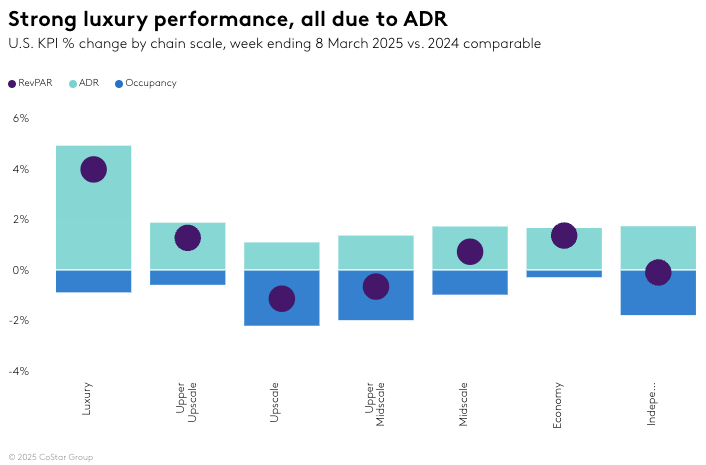

Luxury chain scale on top for the eighth consecutive week

Across the chain scales, ADR was up and occupancy was down. Luxury earned the top spot for the eighth consecutive week with a RevPAR gain of 4%, all on ADR (+4.9%) as occupancy fell. Upper Upscale followed at a more muted pace with RevPAR up 1.3%, also on ADR. Somewhat surprising was the RevPAR decline in the middle two tiers, entirely the result of decreased occupancy (Upscale: -1.1% and Upper Midscale: -0.7%). RevPAR was positive in the lower two tiers (Midscale: +0.7% and Economy: +1.4%), driven by identical ADR gains (+1.7%) while occupancy declined. As has been reported for the past several months, the markets affected by hurricanes in the fall of 2024 lifted the lower tiers. Excluding those markets, RevPAR was negative for both scales.

Group slowed

Group demand in Luxury and Upper Upscale hotels decreased 1.2%, while ADR rose 5.2%. A more dramatic decline occurred in 2019 when group demand dropped 6%. As mentioned earlier, the start of Lent may have contributed to the modest group performance in 2025 like in 2019. Transient demand was essentially flat at -0.2% this year, while in 2019 it was up 0.2%.

The Top 25 Markets saw the largest group decrease, down 5.6% with declines in 15 of the Top 25 Markets. The next 25 largest markets posted flat group demand while group demand across the rest of the country increased 1.9%. On the transient side, demand was up 1.1% in the Top 25 Markets, down 0.6% in the next 25 largest markets and up 2.3% in the remaining markets.

Inconclusive evidence that tariffs are impacting U.S. border markets

A deeper dive into hotel performance along the Canadian and Mexico border produced inconclusive evidence that tariffs were positively or negatively impacting travel flows. There are many factors at play impacting travel, as previously mentioned, which makes it difficult to draw firm conclusions at this stage. The data revealed the following:

Of the 1,306 hotels within 50 miles of the Canadian border, demand over the 28 days ending 8 March was down 2.2%, while in the past week it was down 0.9%. Demand across the U.S. was flat over the past 28 days and down 0.8% for the most recent week.

Of the 916 hotels within 50 miles of the Mexican border, demand over the past 28 days was down 0.2%, while over the past week, it fell 4%. The fact that this past week was the start of Lent was a more likely reason for the soft demand on the Mexican border.

L.A. fires and Southeast U.S. hurricane impact slowly receding

Most of the Los Angeles wildfire impact continued to be centered in three submarkets (Pasadena/Glendale/Burbank, Los Angeles North and Los Angeles East), which have seen elevated demand since the fires. While still elevated (RevPAR 10.9%), it is down from the +20% levels seen over the past eight weeks. The remainder of the greater Los Angeles market saw RevPAR grow 6.9%, with a significant impact from the Natural Products West conference in Orange County.Across the 13 hurricane markets, RevPAR increased 6.1% this week. While significantly higher than the rest of the country, it is showing a steady decline as compared to the most recent four-week average (10.1%) to the previous four weeks (14.8%) and to the peak period in mid-December when the average RevPAR gain over four weeks was 34%.

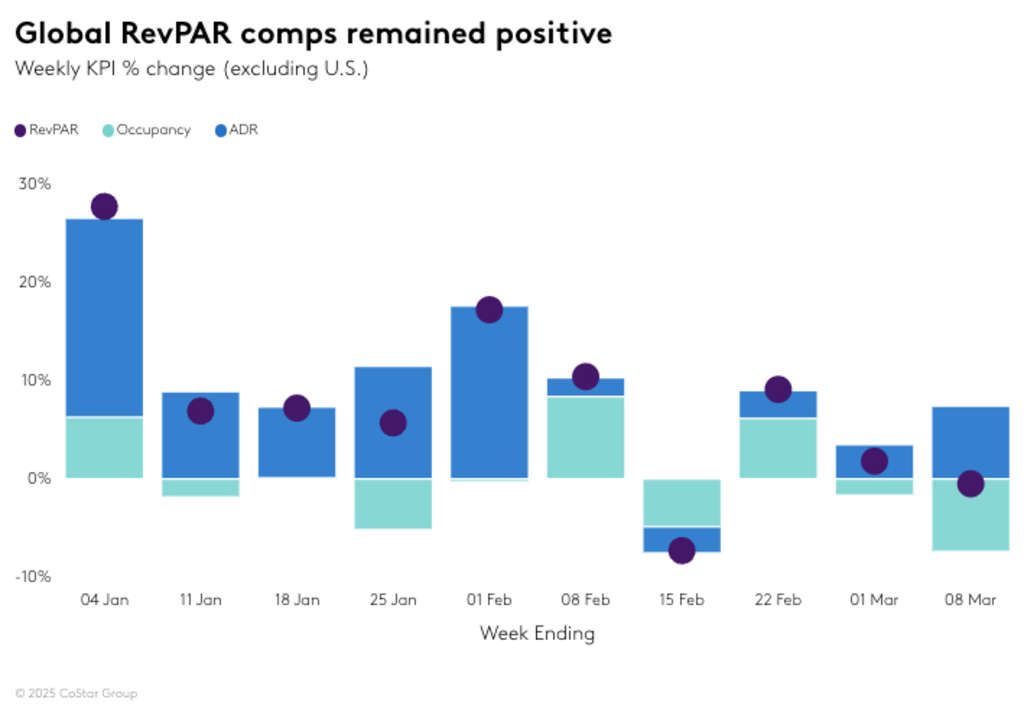

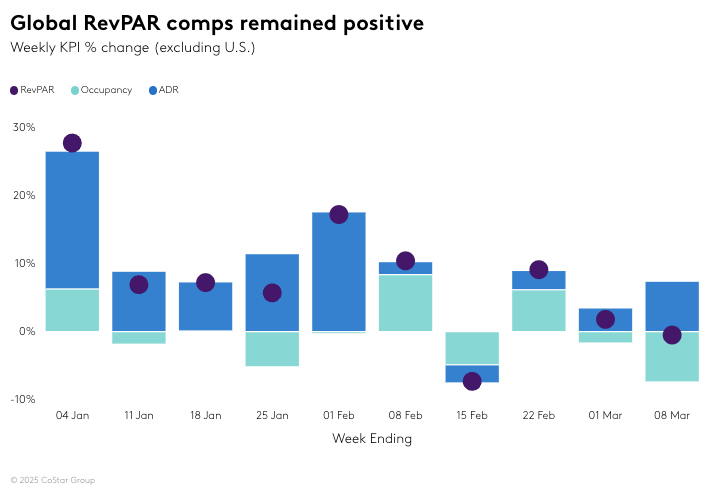

Global slowdown

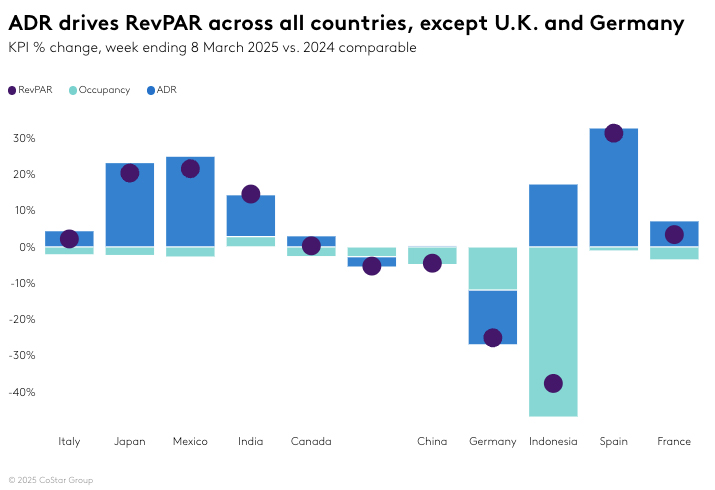

Global occupancy, excluding the U.S., slowed to 61.2% (-4.8ppts) while ADR rose 7.3%, netting a decline in RevPAR (-0.5%). Day-of-week patterns showed occupancy falling by more than 5ppts Tuesday through Thursday then by a lessor amount in the remaining days. ADR was up across all days.

Across the 10 largest countries, based on supply, RevPAR was up by double-digits in Spain, Mexico, Japan, and India. Spain was lifted by the annual Mobile World Congress held in Barcelona 3-6 March 2025, where ADR soared by more than 100%. The nearby Tarragona/Girona/Lleida Province market also benefited. Last year the MWC was held a week earlier which magnified the year-over-year impact.

Japan and Mexico continue to see strong performance, driven entirely by ADR that is somewhat influenced by FX rates.India also produced strong performance ahead of Holi, the Hindu Spring festival.Indonesia was impacted by the Ramadan observance slowing travel from Muslim countries.Similar to last week, Germany, in particular, Düsseldorf and Frankfurt, posted significant declines. Cologne was also negatively impacted this week, most likely the result of event calendar changes.

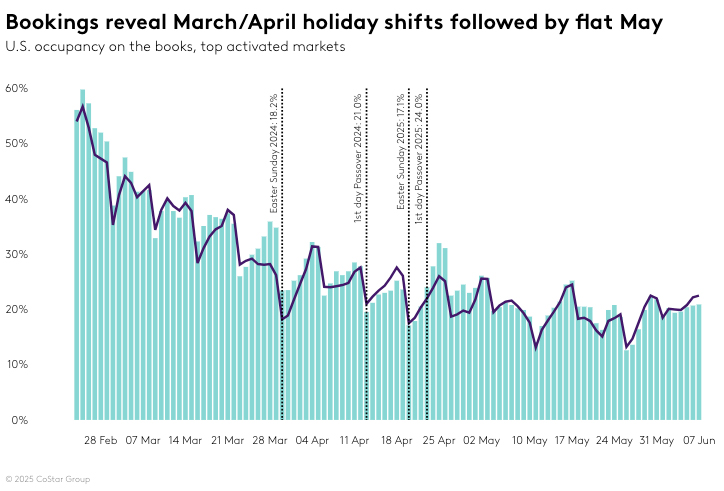

A peculiar week in advance of peak spring travel

Travel stalled last week with multiple factors at place, March Madness is just beginning across the U.S., which will benefit host cities and depress comparisons for last year’s host cities that don’t have that duty again in 2025. Spring Break travel will also be seen in results over the next several weeks. STR’s Forward STAR data is showing both positive and negative weeks ahead due to March/April holiday shifts. May and June are currently looking flat. Spring and summer brings festival season with South By Southwest starting 7 March in Austin, leading the way.

We are still uncertain as to the degree of impact the reductions in the federal government will have on travel. Several major airlines have reduced their forecasts due to increased economic uncertainty in falling consumer confidence. However, outbound U.S. travel in February was still up. The Easter shift will mitigate some of March weakness, but April will see a significant hit due to Easter and a tough comparison due to last year’s Total Solar Eclipse.Globally, we are also seeing some slowdown on occupancy while ADR continued to make significant gains, buoyed in many countries by FX and inflation rates. Americans continuing to travel international certainly provides a tailwind for the global hotel industry.

*Analysis by Isaac Collazo, Chris Klauda.

*All financial figures in U.S. dollar constant currency.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. Thomas Daily is Germany’s largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group’s websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes “forward-looking statements” including, without limitation, statements regarding CoStar’s expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source