Lessors are the largest aircraft owners you’ve never heard of. Most airlines operate at least some aircraft on lease, with the average split between leased and owned falling at around 50%. Fulfilling this need are aircraft leasing specialists, and some of the biggest aircraft lessors have fleets that outstrip many airlines in size.

The biggest aircraft lessors in 2025

According to KPMG’s Aviation Leaders Report 2025, the biggest lessor in the world in 2025 is AerCap by quite some margin. With a total fleet size of 1,676, it has over 900 more aircraft than its next nearest competitor, SMBC.

Japanese by ownership but based in Ireland, SMBC has a sizable fleet of 761 aircraft with a strong focus on the narrowbody side. Coming in third is another Irish company, Avolon, with 583 aircraft. Stay with us as we take a deeper look at each and the rest of the top 10 lessors list.

1: AerCap – 1,676 aircraft

AerCap traces its history back to one of the earliest leasing companies, Guinness Peat Aviation, which was founded in 1975 by Tony Ryan. After a few name and ownership changes, it became AerCap in 2006 and went on to become a major force in the leasing world. Its acquisition of ILFC in 2014 saw it significantly expand its fleet and market share, which was further augmented in 2021 when it acquired GE Capital Aviation Services (GECAS).

It owns aircraft across the spectrum, including the biggest fleet of both single aisle and twin aisle jets in the leasing world. With 278 widebodies, it has more than double the number of its next nearest competitor. It also boasts the largest fleet of leased regional jets in the world, including 45 of the newest generation Embraer E2 jets.

2: SMBC Aviation Capital – 761 aircraft

Founded in 1994 as International Aviation Management Group by Domhnal Slattery, the Royal Bank of Scotland acquired the leasing business in 2001, rebranding it to Lombard Aviation Capital and then in 2004 to RBS Aviation Capital. It was sold to a Japanese consortium of Sumitomo Mitsui Banking Corporation (SMBC), Sumitomo Mitsui Finance and Leasing Company Limited (SMFL) and Sumitomo Corporation in 2012 and renamed SMBC Aviation Capital.

Its portfolio focuses on narrowbodies, with more than 500 of the 761 aircraft in its fleet either A320 or 737 family jets. It has commitments for a further 175 A320neo family aircraft to be delivered, and 83 more Boeing 737 MAX. In 2024, it delivered the first ever Airbus A321LR to Icelandair, and has already signed lease agreements in 2025 with Thai Airways, Turkish Airlines and SKY for more A320neo family aircraft.

3: Avolon – 583 aircraft

Also founded by Domhnal Slattery, Avolon was established in 2010 and has gone on to become the third biggest aircraft lessor in the world. Like the other big lessors, Avolon focuses on narrowbodies, and has over 420 single aisle aircraft in its fleet. Alongside these, it also has 28 A330neos, 27 Dreamliners and 23 A350s, with more of each on order.

Avolon is growing in 2025, as it agreed in late 2024 to acquire smaller rival Castlelake Aviation. The deal, which closed in January 2025, will add another 106 aircraft to its fleet plus production slots for 10 new technology aircraft. Alongside this, the lessor has commitments for 571 new aircraft to be delivered, including 325 more A320neo family jets and 131 more 737 MAX.

4: Air Lease Corporation – 575 aircraft

The first of the biggest aircraft lessors to not be headquartered in Dublin, Air Lease Corporation (ALC) was established in 2010 by aviation legend Steven Udvar-Házy. Having previously founded ILFC, he left to set up ALC along with ILFC COO John Plueger. The company supplies aircraft to a huge number of global airlines and generated record revenues in 2024 of over $2.7 billion, with a $574 million profit.

Air Lease has a slightly more widebody weighted split between aircraft types, although the bulk of its fleet is still narrowbody. The A321neo accounts for 22.1% of its owned fleet, while the 737-800 and 737 MAX 8 make up a further 24%. On the widebody side, it has a fleet of 38 Dreamliners, accounting for almost 8% of the total fleet, while the A330neo makes up almost 6% with 28 aircraft.

5: ICBC Aviation Leasing – 504 aircraft

Wholly owned by ICBC Bank, ICBC Aviation Leasing began life in 2010, and was spun off as a subsidiary in 2018. It has quickly grown to become one of the leading players in China’s leasing industry. By the end of 2018, it had placed 385 aircraft with customers, making it the sixth-largest lessor in the world and the biggest in China.

Although the sheer number of aircraft put ICBC in fifth place in terms of fleet size, it has a relatively large number of regional aircraft with 37 in its fleet. As such, if we were considering the capital value of its portfolio ($16.4 billion) it would fall to seventh place in the ranking. Nevertheless, the company has a sizable fleet with 418 narrowbodies and 49 widebodies alongside its regional aircraft.

6: BOC Aviation – 463 aircraft

BOC Aviation, originally established in 1993 as Singapore Aircraft Leasing Enterprise (SALE), was acquired by the Bank of China in 2006 and rebranded BOC. It serves a diverse assortment of 90+ airlines across 48 countries, including carriers like Cathay, Qantas, Air France, Turkish, Emirates, LATAM and many more.

Its fleet strategy is focused on modern narrowbodies. Although it has dozens of A320ceo and 737 NG aircraft in its fleet, it is rapidly building a huge portfolio of new technology aircraft. BOC has 140 A320neo family aircraft in its fleet, plus 129 more on order. On the Boeing side, it has 69 737 MAX in service, with 96 more on order.

7: BBAM – 452 aircraft

Babcock & Brown Aircraft Management (BBAM) originated in Australia and was established in 1989. In 2010, following the collapse of its parent company, BBAM’s senior management acquired the aircraft leasing business, securing its future as an independent aircraft leasing company.

Today, it is transitioning to a new technology focus, although it strategically maintains a large fleet of older aircraft too. With 117, the most numerous is the Boeing 737-800, although it is adding 737 MAX aircraft too. On the Airbus side, the fleet is slowly getting heavier on the neo side, while it also has 25 large widebody A350 aircraft.

8: DAE Capital – 410 aircraft

Dubai Aerospace Enterprise (DAE) Capital, based in the UAE, has grown enormously in the last decade, largely thanks to its 2017 acquisition of Ansett Worldwide Aviation Services (AWAS). The merger of the two companies propelled DAE to the position of one of the largest lessors in the world, with a fleet of 400 aircraft.

KPMG values DAE at $10.5 billion, making it only ninth largest lessor in market value, but its big fleet of 410 aircraft puts it eighth in size. Alongside 302 narrowbody aircraft, it has a large fleet of 67 ATR-72 turboprops and 41 widebodies. Its average fleet age is just 6.3 years, and it does business with a huge 128 different airlines.

DAE has announced plans to acquire Nordic Aviation Capital, which would take its fleet to around 750 aircraft, albeit mainly turboprops.

9: Carlyle Aviation Partners – 372 aircraft

Carlyle Aviation Partners, originally founded as Apollo Aviation Group in 2002 by Bill Hoffman and Robert Korn, began by focusing on mid-life aircraft and engine leasing. From here, the company has grown through acquisitions and aircraft purchases to become the ninth largest in the world in fleet size. This focus on the resale market does, however, result in a lower valuation of $8.6 billion, making Carlyle 13th largest in market value.

Across the fleet, it has 336 narrowbody and 36 widebody aircraft – many of these widebodies are freighters. All in, it leases aircraft and engines to 111 airlines across 53 countries. As well as leasing, the company does a solid trade in strategic financing initiatives, providing liquidity to airlines in times of need.

10: Aviation Capital Group – 370 aircraft

With a long history in aircraft leasing, Aviation Capital Group (ACG) has built strong relationships with its customers and continues to place most of its 370 aircraft portfolio with airlines all over the world. Focusing intensely on narrowbody leasing, the company has only 15 widebodies in its fleet, and a large backlog for 140 new technology aircraft like the A320neo and 737 MAX.

Last year, ACG finalized an order for 35 Boeing 737 MAX jets, including the -8 and -10, and has orders in place for A320neos as well as 20 Airbus A220s. Recently, it has been involved in several sale and leaseback transactions with Air India Express, helping the airline modernize its fleet affordably.

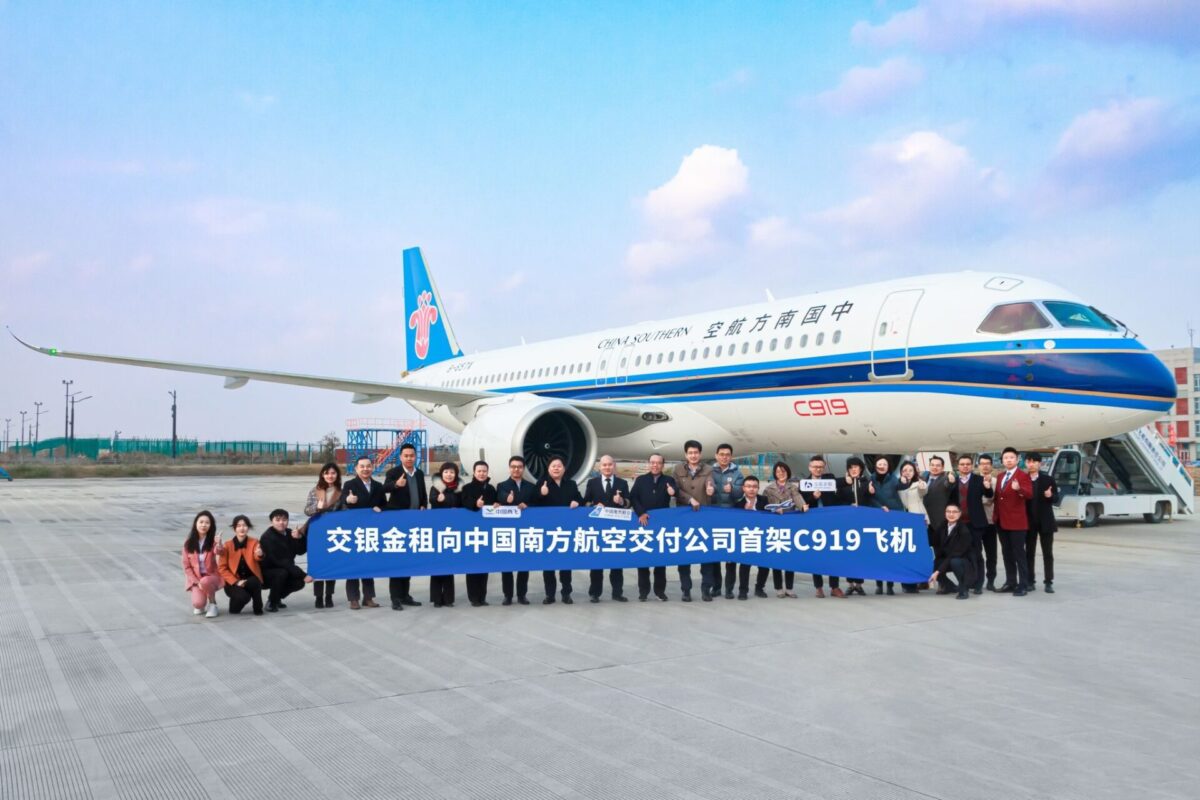

Although Bocom didn’t make the cut for the top 10 aircraft lessors by fleet size, its substantial fleet of new technology aircraft makes it one of the most valuable. With a valuation by KPMG of $10.5 billion, it would be the 10th largest lessor in the world if we considered market value.

It is a wholly owned subsidiary of The Bank of Communications, one of China’s leading commercial banks, and has been on a growth trajectory for many years. It was among the first to be approved to establish a subsidiary in free trade zones. So far, the company has set up businesses in Shanghai, Tianjin, Nansha and Ireland.