Don’t get me wrong—my wife and I have enjoyed our 1978 turbocharged Cessna 310R twin—powered by two Continental TSIO-520B engines. It’s been an outstanding family aircraft—fast, capable and a joy to fly. But there’s no denying the high-performance piston airplane landscape is changing. It’s becoming more challenging to find high-quality maintenance without dealing with long lead times, replacement engine costs are out of control and there’s grave uncertainty about the future of 100LL.

Discussions with fellow pilots seem to echo the same underlying sentiment: Are we being forced out of the piston engine world? With no clear resolution in sight, these mounting concerns have me questioning whether it’s time to part with our beloved Twin Cessna and make the leap into the turboprop world.

With hopes of talking myself off the ledge and to get a clearer picture of where piston-powered aviation is heading, I visited Continental Aerospace Technologies in Fairhope, Alabama, for an open discussion with their marketing and engineering team. I walked away with some new perspectives—and a deeper understanding of the issues at hand—but with plenty of concerns unanswered.

Maximizing Engine Life

Right at the source, I asked Continental engineers what it is that I can do to not only fly my two engines to TBO, but to exceed it. They run strong, oil consumption is low and oil analysis reports look good. Continental’s response aligned with their well-established guidance. The key? Fly regularly.

Each flight should last at least an hour to ensure the cylinders and oil reach proper operating temperatures—375 degrees F for cylinders and 180 degrees F for oil—helping to burn off moisture and contaminants. Simply warming the engines on the ground isn’t enough and could be worse than not running them at all.

What should be obvious upkeep chores but not always accomplished, regular oil changes and staying on top of scheduled inspections go a long way in engine longevity. While oil analysis is a valuable tool, one bad report shouldn’t trigger a knee-jerk reaction—trends over time matter more than a single data point. For owners needing guidance, Continental says its technical support team is easily accessible via phone and email. Still, eventually we’re faced with engine swaps and overhauls—a growing dilemma.

Crisis: Delays, Price Spikes

One of the most pressing challenges for owners has been the lengthy lead times for new engines—a problem affecting the industry as a whole and not just at Continental. Continental explained that supply chain issues are still wreaking havoc. “It’s not just one part that causes delays,” I was told. “There are hundreds of parts that go into an engine and it only takes one part to throw the whole schedule off.” Making matters worse, suppliers are increasingly reluctant to work in aviation due to high quality standards and liability risks. Automotive supply chains that used to provide components have scaled back, citing low aviation volumes and higher risks. As a result, Continental estimated 90-day lead times for “in-demand engines,” like the TSIO-550-K2B. Labor isn’t exactly available, either.

Like many shops, Continental Services, the manufacturer’s maintenance, repair and overhaul (MRO) facility in Fairhope, Alabama, has also been facing delays. When I called in October 2024 to inquire about getting my fuel system worked on they told me it could take six to nine months before I could even schedule an appointment. I raised this with Continental and they acknowledged the backlog, citing not just a shortage of parts but also a shortage of technicians, exacerbated by competition from larger employers like Airbus in nearby Mobile, Alabama. Unfortunately, long wait times for service are a common issue across the country, though the situation in Fairhope is among the worst I’ve encountered.

Another major concern is the steep rise in engine and component costs, including cylinders. Continental attributes these price hikes to broader industry challenges that have emerged since the pandemic, insisting that while costs have gone up, their profit margins have not. However, my own research painted a different picture, showing significant profit growth for Continental in recent years.

I followed up to ask for clarification and like other owners, contemplated whether the brisk-selling piston singles from Cirrus (all SR22 models are Continental-powered) played a role. Continental’s response was brief: “Financial performance is influenced by multiple factors, and we have no further comments to share at this time.”

Unleaded AVgas

The looming phaseout of leaded aviation fuel is another contentious issue. For high-compression engines, which include almost every single non-turbocharged Continental model, the future is especially uncertain. The FAA has set a 2030 deadline, and while alternative fuels are being tested and the FAA approved GAMI’s G100UL through an STC, there’s no industry-wide solution yet.

I asked Continental whether running unleaded fuel in my 520-series engines would impact the warranty. They directed me to their website for a list of approved fuels, stating that the warranty follows those guidelines. However, I couldn’t find any Continental engines currently approved to use GAMI’s G100UL. Pressing further, I asked Continental if there are any plans to add GAMI’s G100UL fuel to the approved list for low-compression engines. Their response was vague: “We have not had the opportunity to test this specific fuel; however we are open to evaluating non-approved fuel specs, ensuring they align with our commitment to safety and performance.” I had hoped for more clarity on how Continental plans to comply with the FAA’s EAGLE initiative, but for now, it seems we are left waiting. Hopefully, a viable—and affordable—solution is announced well before the 2030 deadline.

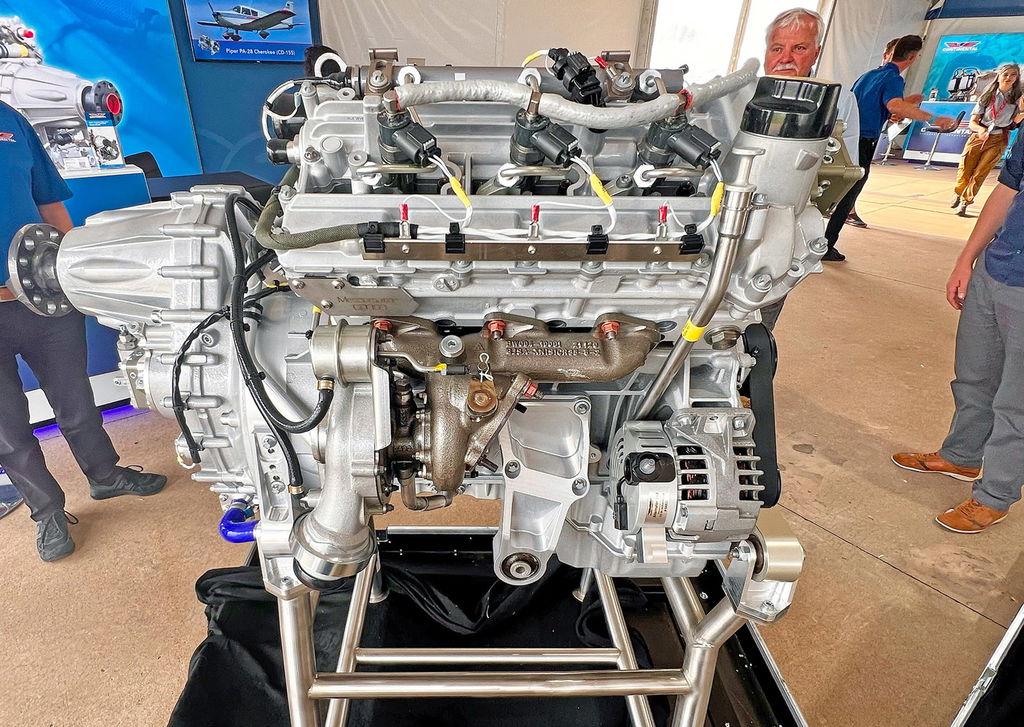

Meanwhile, turbo-diesel engines are the wild card, and gaining at least some OEM traction. Curious about Continental’s progress with their CD series, I asked where they’re seeing the most adoption. Surprisingly, they said the U.S. market is picking up momentum, driven by the engines’ efficiency, simplicity and the advantage of sidestepping the ongoing fuel debate.

Continental views diesel as an expanding product line, and at AirVenture 2024, it announced a partnership with APUS Zero Emissions to develop an STC for the Cessna Stationair 206. An update is expected soon, with a fully converted 206 potentially making its debut at AirVenture 2025.

Turboprop Temptation

After my visit to Continental, I started seriously looking at turboprop alternatives that would align with my mission and budget. With rising engine costs and ongoing fuel uncertainty, one thing is clear—high-performance piston engine ownership is drastically changing. While diesel engines offer an alternative, their price tags often push high-performance aircraft like the DA50RG and DA62 into turboprop territory.

What remains unclear is how manufacturers plan to keep piston-powered aviation viable in the long run. As owners, we need more transparency from the industry’s biggest players. In a current market that’s skeptical and frustrated, the future will depend on it.

This story originally appeared in Aviation Consumer Magazine.